LatAm VC in 2025: What’s Really Going On at the Halfway Mark

A midyear attempt to cut through the noise and decode where LatAm VC might actually be heading

I’ll be honest—I expected things to be significantly better by this time of year.

2023 and 2024 were rough for venture capital, especially in LatAm, but there were some positive signals toward the end of last year: a couple of quarters with upward momentum in capital deployment and expectations that the IPO market would finally show signs of life—bringing with it a rebound in liquidity.

That said, a handful of successful IPOs—Chime, Circle, CoreWeave, to name a few—show it’s not all bad.

It’s hard to pinpoint the exact root cause, but the tariffs narrative has clearly disrupted global financial sentiment, impacting the IPO market, which now looks likely to remain sluggish through the rest of the year. Informal conversations with colleagues all land in a similar place: it’s been a slow first half of 2025.

I’ll try to make some sense of what this means for the VC market in LatAm through a few key trends.

VC: Still Selective, Still Focused on AI

Investors remain highly selective, concentrating on late-stage and AI-driven deals.

Per Pitchbook, Series A companies—particularly those in AI—are seeing valuation growth similar to what we experienced in 2021. This has created a clear divergence: AI companies are on a different trajectory than their non-AI counterparts.

The following graph by Silicon Valley Bank (SVB) clearly illustrates the trajectory of AI VC vs. non-AI VC.

What about LatAm? Over 90% of AI-related VC in Latin America is still going into pre-Seed or Seed-stage companies. When it comes to AI, we’re just getting started. As a result, global AI players still aren’t paying much attention to the region—but there’s room for that to change.

At the later stages in LatAm, investors are cherry-picking Series B+ rounds, backing businesses that are already established and showing leadership in their markets. According to Pitchbook, the current environment for this cohort looks more like 2014–2020—not the 2021 peak, but still solid.

In the U.S., 61% of VC mega-deals (deals over $100M USD) went to AI companies. LatAm is a different story: mega-deals are being captured by companies that have built sustainable businesses over the last 5–10 years and are positioned as category winners (e.g., Merama, Klar, Clip).

What to expect in H2 2025: More growth deals—and this may be more positive than we think. Growth deals generally include secondaries, which means liquidity for Pre-Seed and Seed investors. On the AI front, we’re clearly lagging, but keep an eye on LatAm AI companies capturing a larger share of mega-deals in the coming years.

M&A and Secondaries: Activity Picking Up, But Not Enough

The M&A market is active. In the U.S., 2025 is on track to surpass 2024 in total transactions—driven mostly by small acquisitions and acqui-hires. Unfortunately, according to SVB data, bankruptcies are also on the rise.

In LatAm, we’re seeing something similar: startups with great tech but little runway (many last raised in 2021–2022) are being picked up at favorable terms. It’s hard to get a real pulse on the market, as few want to disclose information on these deals—the same applies in the U.S.

On the secondary side, global VC secondary deal volume is projected to surpass $20B in 2025 (up from $14B in 2024).

As unrealized gains continue to grow—and LPs crave liquidity while GPs seek to improve DPI before launching new funds—secondaries are a lever more managers are pulling.

In Latin America, secondary-focused funds are emerging, and we’re seeing some managers blend primary and secondary deals to reset valuations. This is just getting started.

What to expect in H2 2025: M&A activity will continue to grow. I’d expect a few deals in the high tens or low hundreds of millions, along with increased activity in smaller acqui-hires in the second half of the year.

VC Fundraising: Mega-Funds Win, Everyone Else Struggles

VC fundraising remains in a tough spot. While data lags, 2025 is likely to come in below both 2024 and 2023 in the U.S.

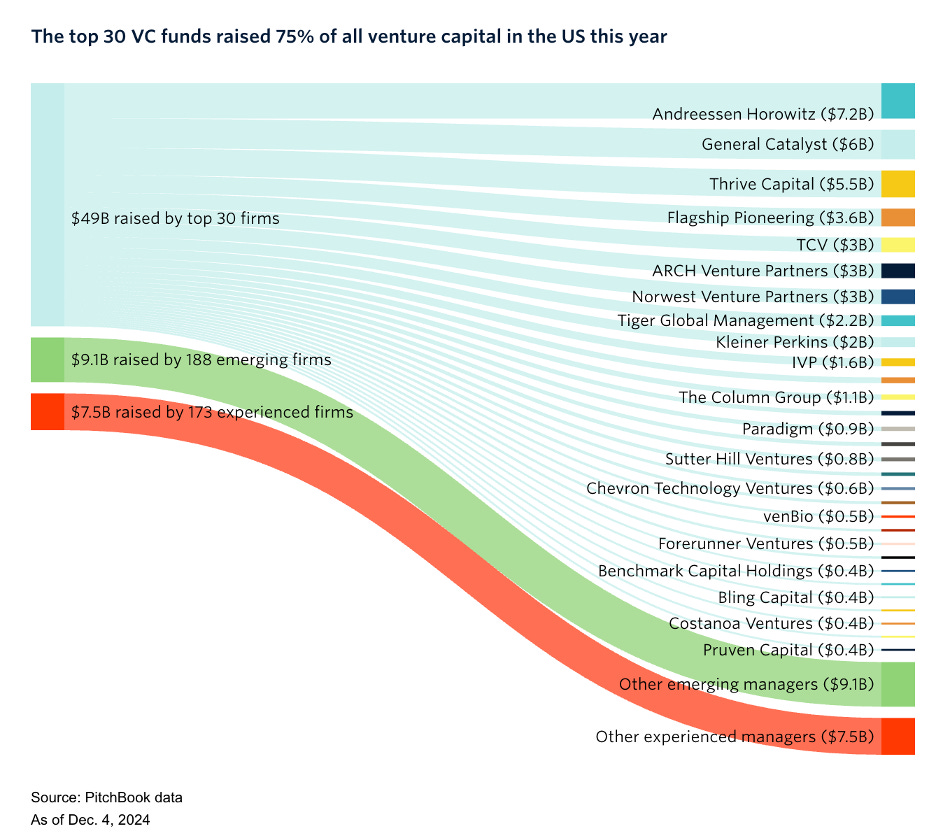

In 2024, just nine firms accounted for 50% of all venture fundraising. We’ve all seen the Pitchbook chart.

If emerging managers are struggling in the U.S., LatAm is no different. I’ll be keeping an eye on how many new closings from Spanish-speaking funds are announced by year-end. A lot of managers don’t have dry powder for new deals. This will also impact startup fundraising—regardless of performance, it’s tough to find players writing meaningful checks.

Brazilian funds are increasingly deploying outside their home market, and I expect to see more of them joining rounds in Spanish-speaking LatAm during H2.

What to expect in H2 2025: Brazilian funds will hit their fundraising targets (or come close), but it won’t be easy. Ex-Brazil, fundraising will likely stretch into 2026. The bigger takeaway: if you're a startup looking to raise, make sure you can tap into the Brazil VC ecosystem.

Startup Trends: Bridges, Stretching Timelines, and a Reality Check

Carta data shows a few standout trends:

46% of all Seed rounds so far this year have been bridge rounds (a record high)

Average time from Seed to Series A is now 29 months, up from 22 months pre-2021

In the last nine quarters, at least 18% of all new priced rounds have been down rounds

Startups are being forced to get creative with their fundraising strategy. As demand for capital outpaces supply, raising a bridge round and extending runway has become an attractive proposition—especially if it can be done at a higher valuation than the last round. This stretches the timeline to fundraise a new Series, giving companies time to:

Improve metrics and become more attractive to potential leads

Wait for market conditions to (hopefully) improve

What to expect in H2 2025: I’d be surprised if these trends change much in the short term. As funds exhaust their remaining capital, the percentage of bridge rounds might start falling in 2026. Still, down rounds are likely to remain common, as many companies that do raise will face valuations below those of 24–48 months ago.

Conclusion

All in all, 2025 hasn’t delivered the rebound many were hoping for—but it’s not a write-off either. The IPO window hasn’t reopened meaningfully, fundraising remains a slog, and early-stage startups are navigating longer timelines and tighter capital.

At the same time, we’re seeing real signals of activity: growth rounds in LatAm, a rising secondary market, and selective M&A that could lay the groundwork for healthier exits in the future.

The next six months won’t be easy, but they’ll be important. How investors deploy remaining capital, how startups adapt to extended cycles, and whether LPs regain confidence will shape not just the rest of 2025—but the broader tone heading into 2026.